Reports related to this article:

Project(s): View 2 related projects in PECWeb

Pipeline(s): View 2 related pipelines in PECWeb

Drive(s): View 1 related drive in PECWeb

Unit(s): View 2 related units in PECWeb

en

SUGAR LAND--February 18, 2014--Researched by Industrial Info Resources (Sugar Land, Texas)--There's really little need to reiterate the positive effects that unconventional oil and gas drilling is having on the U.S. economy and energy markets. Only a few years ago, most people would have thought it ludicrous that the U.S. was on its way to becoming the world's leading producer of crude oil and would begin exporting, rather than importing, vast quantities of natural gas.

The most recent stories in the media have been focused on crude oil, as the Bakken and Eagle Ford shales continue reaching new heights of production, and the debate whether to lift the restrictions on U.S. crude oil exports rages. However, at Industrial Info's most recent Industrial Market Outlook, held in Houston, Texas, on January 29, the focus was definitely on gas.

"While crude oil is a very important commodity that's coming out of this market, it's really natural gas and natural gas liquids that are going to lead our country to become more of an export player," said Michael Bergen, executive vice president at Industrial Info, during the outlook presentation, explaining the continued positive effects that increased U.S. natural gas production is having across all industrial sectors.

According to Industrial Info's project spending data, overall industrial spending in the U.S. in 2013 remained relatively flat, hovering just below the $260 billion mark for both 2012 and 2013. While total spending remained stable, there was some fairly large movement within individual industries. Spending within the Power Industry, for example, showed significant pullback, declining more than 15% from approximately $74.86 billion in 2012 to $63.39 billion in 2013. However, spending in the Oil & Gas and Chemical Processing industries rose significantly, helping offset the decline in Power Industry spending.

Spending in the Terminals, Pipelines and Production industries showed 25.2% growth, rising from a total of approximately $32.6 billion in 2012 to $40.8 billion in 2013, as oil and gas production in the nation continues to grow, and necessary storage and transmission infrastructure is put in place. Spending in the Chemical Processing Industry, which benefits directly from inexpensive natural gas feedstock, increased almost $1.5 billion year over year and will continue to escalate.

Growth in Other Sectors, Geographic Areas

In 2014, the nation's expanding oil and gas production is poised to continue its dramatic growth, and this contributes to rising project spending across all industrial sectors. "We've realized a lot of the spending opportunity taking place in the field itself, getting the product to market, storage tanks, and things of that nature," said Bergen. "We're just now starting to get on the cusp of where other industries are benefitting from this development."

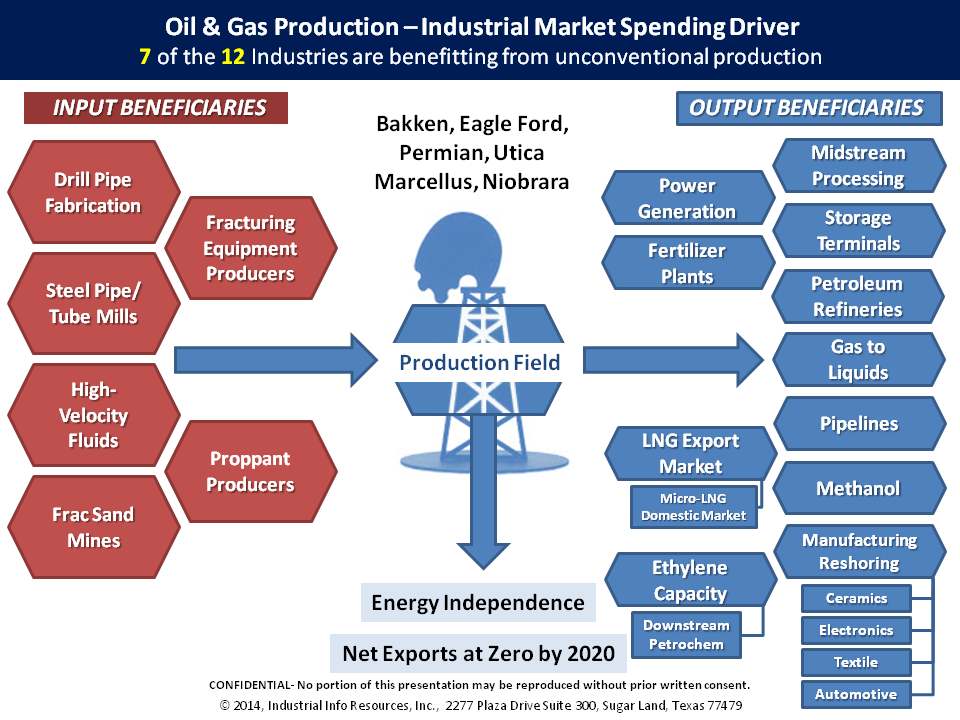

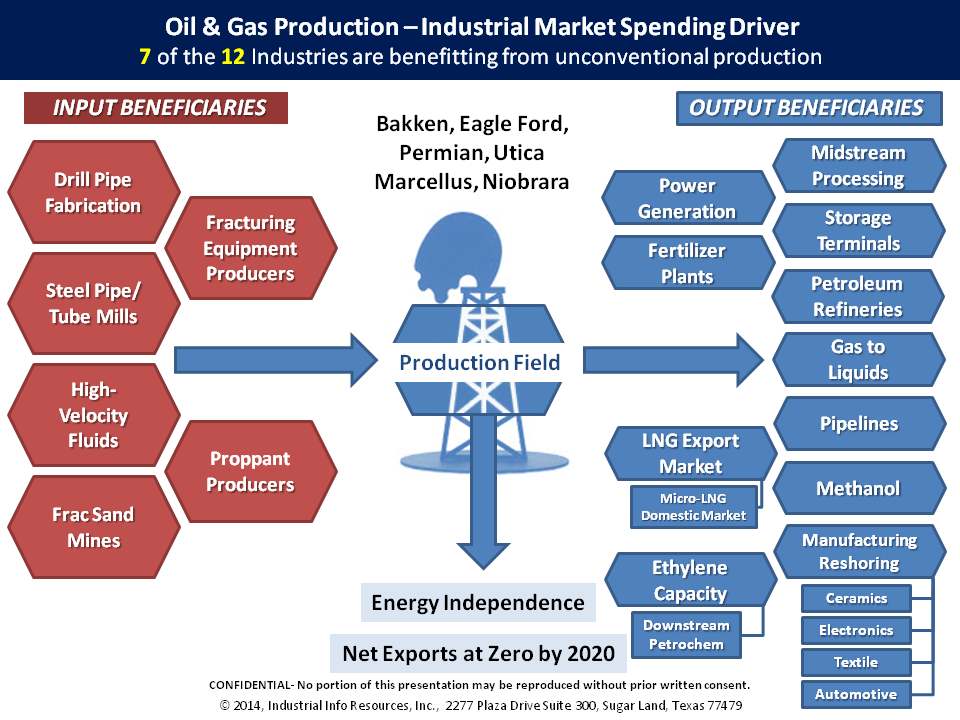

And these benefits are set to lift U.S. industrial project spending in 2014 by more than 10% from last year. For the past few years in the U.S., much of the spending that has occurred has been directly involved in the oil & gas extraction process: drill pipe fabrication, fracking equipment producers, steel pipe/tube mills, etc. Spending is now reaching into new sectors. Midstream natural gas processing and fractionation projects have escalated significantly, particularly in the Eagle Ford and Marcellus areas.

And these benefits are set to lift U.S. industrial project spending in 2014 by more than 10% from last year. For the past few years in the U.S., much of the spending that has occurred has been directly involved in the oil & gas extraction process: drill pipe fabrication, fracking equipment producers, steel pipe/tube mills, etc. Spending is now reaching into new sectors. Midstream natural gas processing and fractionation projects have escalated significantly, particularly in the Eagle Ford and Marcellus areas.

Ethylene unit additions are also adding billions of dollars of project spending into the mix. "We anticipate seeing about 10 new world-scale crackers get built in the future," said Bergen, noting that spending wouldn't finish with the completion of these units. "What we haven't yet seen is the downstream olefins products units that come out of this." Downstream petrochemicals projects that use ethylene as feedstock will continue filling the Chemical Processing project pipeline well into the future, as these ethylene units come online.

Another result of the decreased natural gas price is its positive impact on the U.S. manufacturing sector. Production of ceramics, electronics and automotive parts is returning to the U.S., said Bergen, who also noted that the U.S. textile industry, which for the past several years has been in severe decline, is returning manufacturing to U.S. shores. "We're tracking $800 million worth of textile mills being built and coming back to life in the Carolinas, which is pretty exciting."

Tightening Labor Market

A consequence of this continued escalation in industrial project activity is a severe tightening of the labor market in areas of strong industrial activity, such as the Great Lakes and Gulf Coast regions. The Gulf Coast region between Brownsville, Texas, and Pascagoula, Mississippi, where LNG, Chemical Processing and other project activity is particularly strong, is experiencing a very strong uptick in labor demand, which is set to peak in 2015-16. Industrial Info is forecasting craft labor demand to rise from 96.1 million man-hours in 2013 to more than 144 million man-hours in 2015 as regional industrial construction reaches its peak. Further information can be found in Industrial Info's Industrial Labor Market Forecast, which provides historical and forecast labor demand, supply and wage rates.

Market Outlook Events & Products

This information was initially presented as part of Industrial Info's 2014 Industrial Market Outlook & Networking Event, attended by more than 1,000 people in Houston, Texas, on January 29. Our complementary Market Outlooks are held throughout the year in various locations and allow our industry experts to present information on the market trends and drivers affecting industrial spending both now and in the future, as well as providing attendees some of the best industrial networking opportunities available.

This information was initially presented as part of Industrial Info's 2014 Industrial Market Outlook & Networking Event, attended by more than 1,000 people in Houston, Texas, on January 29. Our complementary Market Outlooks are held throughout the year in various locations and allow our industry experts to present information on the market trends and drivers affecting industrial spending both now and in the future, as well as providing attendees some of the best industrial networking opportunities available.

Our next Market Outlook will be held at The Ritz-Carlton in Washington, D.C., on May 7, followed by others in Jersey City, New Jersey, and Baton Rouge, Louisiana. For more information or to RSVP for these events, visit the Market Outlook page on our website.

In addition, Industrial Info's Global Industrial Outlook is a quarterly-updated online product providing spending statistics and forecasts for 12 industrial sectors throughout the world. Both North American and international industrial sectors are included in the Outlook, with special breakouts for the BRIC, MENA, Middle East and Asia-Pacific regions. Detailed assessments from Industrial Info's industry experts help explain how the data and information reflect broader industrial trends. Visit our Online Store for information on this and other analytics and forecasting products.

Industrial Info Resources (IIR), with global headquarters in Sugar Land, Texas, three offices in North America and nine international offices, is the leading provider of global market intelligence specializing in the industrial process, heavy manufacturing and energy markets. Industrial Info's quality-assurance philosophy, the Living Forward Reporting Principle, provides up-to-the-minute intelligence on what's happening now, while constantly keeping track of future opportunities. To contact an office in your area, visit the www.industrialinfo.com "Contact Us" page.

The most recent stories in the media have been focused on crude oil, as the Bakken and Eagle Ford shales continue reaching new heights of production, and the debate whether to lift the restrictions on U.S. crude oil exports rages. However, at Industrial Info's most recent Industrial Market Outlook, held in Houston, Texas, on January 29, the focus was definitely on gas.

"While crude oil is a very important commodity that's coming out of this market, it's really natural gas and natural gas liquids that are going to lead our country to become more of an export player," said Michael Bergen, executive vice president at Industrial Info, during the outlook presentation, explaining the continued positive effects that increased U.S. natural gas production is having across all industrial sectors.

Did You Miss This Outlook?

Click Here to view Industrial Info's presentation from

the latest Industrial Market Outlook, held Jan. 29, 2014.

Oil & Gas Sector Boosts Top-Line GrowthClick Here to view Industrial Info's presentation from

the latest Industrial Market Outlook, held Jan. 29, 2014.

According to Industrial Info's project spending data, overall industrial spending in the U.S. in 2013 remained relatively flat, hovering just below the $260 billion mark for both 2012 and 2013. While total spending remained stable, there was some fairly large movement within individual industries. Spending within the Power Industry, for example, showed significant pullback, declining more than 15% from approximately $74.86 billion in 2012 to $63.39 billion in 2013. However, spending in the Oil & Gas and Chemical Processing industries rose significantly, helping offset the decline in Power Industry spending.

Spending in the Terminals, Pipelines and Production industries showed 25.2% growth, rising from a total of approximately $32.6 billion in 2012 to $40.8 billion in 2013, as oil and gas production in the nation continues to grow, and necessary storage and transmission infrastructure is put in place. Spending in the Chemical Processing Industry, which benefits directly from inexpensive natural gas feedstock, increased almost $1.5 billion year over year and will continue to escalate.

Growth in Other Sectors, Geographic Areas

In 2014, the nation's expanding oil and gas production is poised to continue its dramatic growth, and this contributes to rising project spending across all industrial sectors. "We've realized a lot of the spending opportunity taking place in the field itself, getting the product to market, storage tanks, and things of that nature," said Bergen. "We're just now starting to get on the cusp of where other industries are benefitting from this development."

And these benefits are set to lift U.S. industrial project spending in 2014 by more than 10% from last year. For the past few years in the U.S., much of the spending that has occurred has been directly involved in the oil & gas extraction process: drill pipe fabrication, fracking equipment producers, steel pipe/tube mills, etc. Spending is now reaching into new sectors. Midstream natural gas processing and fractionation projects have escalated significantly, particularly in the Eagle Ford and Marcellus areas.

And these benefits are set to lift U.S. industrial project spending in 2014 by more than 10% from last year. For the past few years in the U.S., much of the spending that has occurred has been directly involved in the oil & gas extraction process: drill pipe fabrication, fracking equipment producers, steel pipe/tube mills, etc. Spending is now reaching into new sectors. Midstream natural gas processing and fractionation projects have escalated significantly, particularly in the Eagle Ford and Marcellus areas.Ethylene unit additions are also adding billions of dollars of project spending into the mix. "We anticipate seeing about 10 new world-scale crackers get built in the future," said Bergen, noting that spending wouldn't finish with the completion of these units. "What we haven't yet seen is the downstream olefins products units that come out of this." Downstream petrochemicals projects that use ethylene as feedstock will continue filling the Chemical Processing project pipeline well into the future, as these ethylene units come online.

Another result of the decreased natural gas price is its positive impact on the U.S. manufacturing sector. Production of ceramics, electronics and automotive parts is returning to the U.S., said Bergen, who also noted that the U.S. textile industry, which for the past several years has been in severe decline, is returning manufacturing to U.S. shores. "We're tracking $800 million worth of textile mills being built and coming back to life in the Carolinas, which is pretty exciting."

Tightening Labor Market

A consequence of this continued escalation in industrial project activity is a severe tightening of the labor market in areas of strong industrial activity, such as the Great Lakes and Gulf Coast regions. The Gulf Coast region between Brownsville, Texas, and Pascagoula, Mississippi, where LNG, Chemical Processing and other project activity is particularly strong, is experiencing a very strong uptick in labor demand, which is set to peak in 2015-16. Industrial Info is forecasting craft labor demand to rise from 96.1 million man-hours in 2013 to more than 144 million man-hours in 2015 as regional industrial construction reaches its peak. Further information can be found in Industrial Info's Industrial Labor Market Forecast, which provides historical and forecast labor demand, supply and wage rates.

Market Outlook Events & Products

This information was initially presented as part of Industrial Info's 2014 Industrial Market Outlook & Networking Event, attended by more than 1,000 people in Houston, Texas, on January 29. Our complementary Market Outlooks are held throughout the year in various locations and allow our industry experts to present information on the market trends and drivers affecting industrial spending both now and in the future, as well as providing attendees some of the best industrial networking opportunities available.

This information was initially presented as part of Industrial Info's 2014 Industrial Market Outlook & Networking Event, attended by more than 1,000 people in Houston, Texas, on January 29. Our complementary Market Outlooks are held throughout the year in various locations and allow our industry experts to present information on the market trends and drivers affecting industrial spending both now and in the future, as well as providing attendees some of the best industrial networking opportunities available.Our next Market Outlook will be held at The Ritz-Carlton in Washington, D.C., on May 7, followed by others in Jersey City, New Jersey, and Baton Rouge, Louisiana. For more information or to RSVP for these events, visit the Market Outlook page on our website.

In addition, Industrial Info's Global Industrial Outlook is a quarterly-updated online product providing spending statistics and forecasts for 12 industrial sectors throughout the world. Both North American and international industrial sectors are included in the Outlook, with special breakouts for the BRIC, MENA, Middle East and Asia-Pacific regions. Detailed assessments from Industrial Info's industry experts help explain how the data and information reflect broader industrial trends. Visit our Online Store for information on this and other analytics and forecasting products.

Industrial Info Resources (IIR), with global headquarters in Sugar Land, Texas, three offices in North America and nine international offices, is the leading provider of global market intelligence specializing in the industrial process, heavy manufacturing and energy markets. Industrial Info's quality-assurance philosophy, the Living Forward Reporting Principle, provides up-to-the-minute intelligence on what's happening now, while constantly keeping track of future opportunities. To contact an office in your area, visit the www.industrialinfo.com "Contact Us" page.