U.S. Chemical Industry Eyes Wide Swath of Maintenance Projects

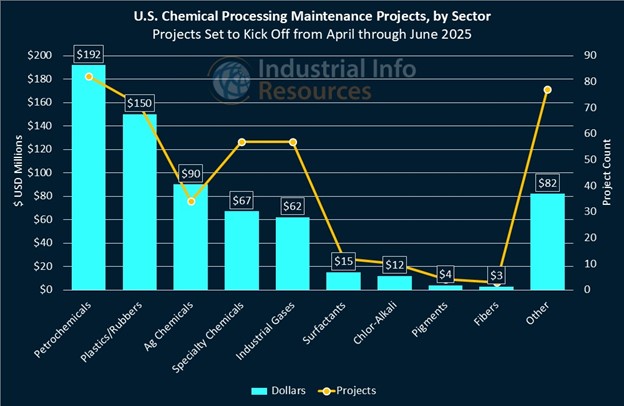

The U.S. Chemical Processing Industry is hoping for a modest recovery in 2025, following several years of weak demand, and producers aim to keep their facilities in the best possible shape. Industrial Info is tracking more than 400 maintenance-related projects across the U.S. Chemical Processing Industry that are set to kick off in the second quarter, with the petrochemical, plastics and rubber, and agrochemical sectors accounting for nearly half of the projects and more than 60% of the total investment.

The U.S. Chemical Processing Industry has faced several years of weak demand for its products, both domestically and internationally, according to the American Chemistry Council (ACC). Chemical production stagnated in 2023 and 2024, but the ACC sees "renewed optimism" for the coming year, according to a press release, "as manufacturers expect demand to improve solidly in the U.S. and modestly in key export markets."

The petrochemical sector almost always leads all other sectors in quarterly maintenance investment, and this quarter is no exception. Three foreign-based companies account for some of the highest-valued projects in this sector, led by Kuwait Petroleum Corporation (KPC), which co-owns MEGlobal Americas Incorporated in a joint venture with Dow Incorporated (NYSE:DOW) (Midland, Michigan). MEGlobal, which specializes in the production of monoethylene glycol (MEG) and diethylene glycol (DEG), collectively known as ethylene glycol (EG), is preparing for a turnaround at its Oyster Creek EG complex in Freeport, Texas. The subsidiary is performing inspections and repairs to a roughly 1.5 billion-pound-per-year MEG plant.

Freeport sits on the Texas Gulf Coast, a hub of the U.S. petrochemical market, and it is home to BASF SE's (Ludwigshafen, Germany) turnaround on the Anone Unit 1 at its Freeport Chemicals complex. About 50 miles east, INEOS Group AG (London, England) is preparing for a turnaround on the Paraxylene Unit 3 at its Plant B in Texas City. All three turnarounds are expected to kick off in April and run for varying lengths.

Subscribers to Industrial Info's Global Market Intelligence (GMI) Chemical Processing Project Database can learn more from detailed project reports on the MEGlobal, BASF and INEOS turnarounds.

U.S.-based petrochemical producers also have a strong presence on the Texas Gulf Coast, including Ascend Performance Materials LLC (Houston, Texas), which is preparing for a 30-day turnaround on its AN-3 Unit at its Chocolate Bayou Intermediate Chemicals Plant in Alvin, located between Texas City and Houston. The unit produces about 1.1 billion pounds per year of acrylonitrile (AN), which is used in the production of acrylic fibers, synthetic rubber and other materials. Subscribers can learn more from a detailed project report.

Louisiana, the other major petrochemicals hub on the Gulf Coast, is home to two major turnarounds from Shell plc (NYSE:SHEL) (London) at its chemical complex in Geismar, Louisiana: a turnaround on the AO-2 unit and a turnaround on the AO-4 unit, both of which produce alpha olefin (AO), a building block for surfactants, lubricants and other chemicals. Subscribers can read detailed reports on the AO-2 and AO-4 projects.

In the agrochemical sector, fertilizer-related units dominate second-quarter maintenance investment, largely due to four turnarounds planned at Koch Industries Incorporated's (Wichita, Kansas) nitrogenous fertilizers plant in Enid, Oklahoma:- Urea Unit 1, which produces about 200,000 metric tons per year of urea; see project report

- Urea Unit 2, which produces about 800,000 metric tons per year of urea; see project report

- Ammonia Unit 1, which produces about 1,600 tons per day of ammonia; see project report

- Ammonia Unit 2, which produces about 1,600 tons per day of ammonia; see project report

SABIC Innovative Plastics Holding BV, a subsidiary of Saudi Aramco (Dhahran, Saudi Arabia), is one of the top investors in second-quarter maintenance projects in the plastic and rubber sector. SABIC is planning a turnaround on the polycarbonate plant at its plastics complex in Burkville, Alabama, which produces roughly 595 million pounds per year of phosgene, resins and other essential ingredients for plastics and rubber. Subscribers can learn more from a detailed project report.

Subscribers to Industrial Info's GMI Project and Plant databases can click here for a full list of detailed reports for projects mentioned in this article, and click here for a full list of related plant profiles.

Subscribers can click here for a full list of reports for maintenance-related projects across the U.S. Chemical Processing Industry that are set to kick off in the second quarter.