U.S. Data Centers to See $29 Billion in Fourth-Quarter Kickoffs

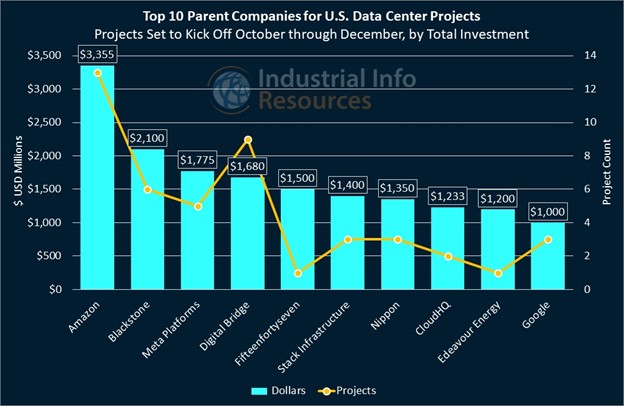

The seemingly endless growth in data centers across the U.S. is changing landscapes across multiple industries. The storehouses for internet services, artificial intelligence and cryptocurrency are expected to be a major driver in energy demand for years to come, and likely will become crucial hubs for American business. Industrial Info is tracking $29 billion worth of U.S.-based data center projects that are set to begin construction in the fourth quarter, more than 40% of which is attached to projects in Arizona, Virginia or Georgia.

Earlier this summer, Industrial Info presented a complimentary webinar regarding the outlook for the global data center and semiconductor sectors, led by David Pickering, IIR's vice president for the Industrial Manufacturing Industry. For more information, see June 27, 2024, article - IIR Webinar: Rapid Growth in Data Center & Semiconductor Sectors Brings Strong Spending, New Challenges.

Few would be surprised to learn Amazon.com Incorporated (NASDAQ:AMZN) (Seattle, Washington) leads in both the project count and total investment value of fourth-quarter data center kickoffs. Most are expansions at existing facilities, such as the $400 million Phase IV at the Johnstown Data Center Campus in New Albany, Ohio, which is part of a broader, $1.1 billion effort to enhance cloud services in the region.

The Amazon Web Services business also is bolstering its regional footprint in the Mid-Atlantic, where it expects to begin construction on a major grassroot project: the $300 million Phase I of the Cosner Tech Data Center Campus in Fredericksburg, Virginia. Ohio and Virginia account for more than 80% of Amazon's $3.35 billion in fourth-quarter data center kickoffs. Subscribers to Industrial Info's Global Market Intelligence (GMI) Industrial Manufacturing Project Database can read detailed reports on the Johnstown and Cosner projects.

Virginia also is home to one of the largest projects from Blackstone Group Incorporated (NYSE:BX) (New York, New York), which is second only to Amazon in its total investment in upcoming project kickoffs: the $300 million Phase III for its D.C. Data Center Campus in Manassas, which is part of the metropolitan statistical area that includes the District of Columbia. Quality Technology Services, which Blackstone acquired in 2021, completed the first two phases in 2019 and 2022, and is considering two additional expansions that could begin as early as 2026. Subscribers can read more in a detailed project report.

Other tech titans with looming kickoffs include Google's parent company Alphabet Incorporated (NASDAQ:GOOGL) (Mountain View, California), which is building out its presence in the Great Plains region with a $300 million data center in Lincoln, Nebraska. Growing populations and business in the Mid-Atlantic and Great Plains states have made them a popular destination for data center developers, accounting for more than $15.5 billion in project completions over the past five years, according to Industrial Info's GMI database. Subscribers can learn more about the Nebraska project in a detailed project report.

But it's not just the big names that are staking out territory. Novva Data Centers (West Jordan, Utah), a privately held company founded in 2018, already has started engineering work on its $550 million Tahoe Reno Data Center in McCarran, Nevada, while Prime Data Centers LLC (Dallas, Texas), founded in 2017, is in a similar stage developing its $420 million Hermosa Ranch Data Center in Avondale, Arizona.

Despite their relatively young ages, Novva and Prime already have a total of five operational data centers across the U.S., with another 15 in various stages of development. Subscribers to Industrial Info's GMI database can read detailed reports on the Tahoe Reno and Hermosa Ranch projects.

Foreign-based developers also are adding to the data center landscape. NTT Global Data Centers Americas, a subsidiary of Nippon Telegraph and Telephone Corporation (Tokyo, Japan), is preparing for a $250 million Phase III expansion of its campus in Hillsboro, Oregon. NTT Global already has nine operational data centers across the U.S., with another three grassroot projects in development. Subscribers can learn more about the Oregon project in a detailed project report.

Data centers play a leading role in the energy transition, but are creating ethical headaches for their developers, who often source their materials from nations with poor records on human rights and environmental concerns. For more information, see August 12, 2024, article - Big Tech, Energy Transition and Conflict Minerals: A Growing Concern.

The rapid growth of data centers--which typically consume heavy amounts of energy--also is a contributing factor in the decision to keep several U.S.-based coal-fired power plants alive. For more information, see July 15, 2024, article - Power Plant Owners Continue to Delay Closure of Coal-Fired Generation.

Subscribers to Industrial Info's GMI Project and Plant databases can click here for a full list of detailed reports for projects mentioned in this article, and click here for a full list of related plant profiles.

Subscribers can click here for a full list of reports for U.S.-based data center projects that are set to begin construction in the fourth quarter.